- REVIEWS ABOUT AXON TRUCKING SOFTWARE DRIVERS

- REVIEWS ABOUT AXON TRUCKING SOFTWARE DRIVER

- REVIEWS ABOUT AXON TRUCKING SOFTWARE SOFTWARE

- REVIEWS ABOUT AXON TRUCKING SOFTWARE FREE

REVIEWS ABOUT AXON TRUCKING SOFTWARE SOFTWARE

The basic package of the software covers costs and profits without specifics on customers and loads.

This online software is available in 4 different packages meant for a trucking company that operates from 1 to 5 trucks.

The owner-operator edition will do the job in our case as it has all the required truck management features and the required accounting services or functionality required to operate the business.

REVIEWS ABOUT AXON TRUCKING SOFTWARE FREE

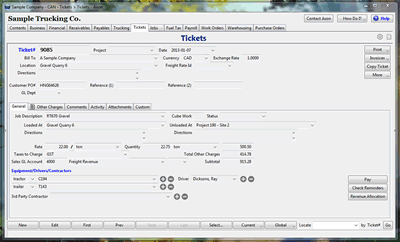

Every user pays a one-time fee that includes free tech support and future software upgrades. This affordable app is available in three editions which are basic, owner-operator and small fleet edition. This desktop accounting software for trucking offers basic features like payroll and truck management features such as trip planners and vehicle maintenance logs. This affords you true flexibility since you are better positioned to support customers of different types and to grow your trucking business.

REVIEWS ABOUT AXON TRUCKING SOFTWARE DRIVERS

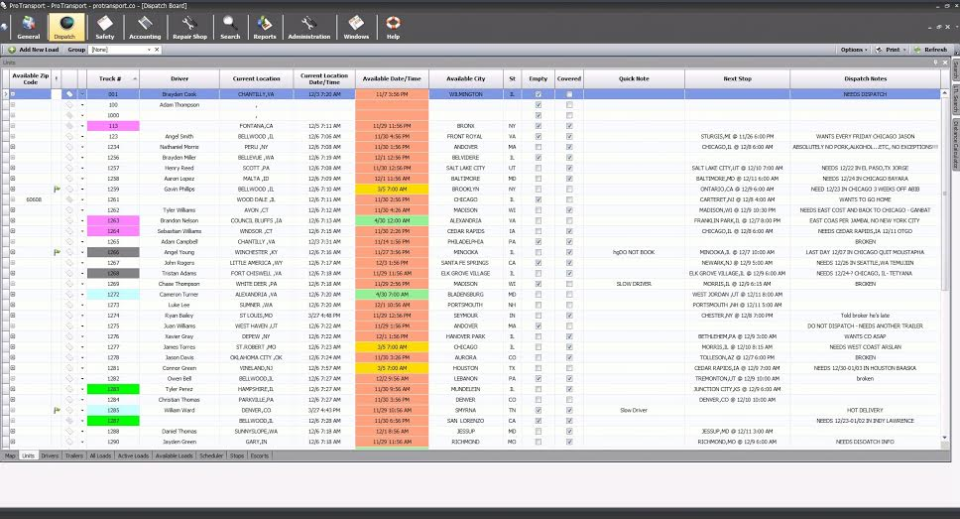

The software for truck drivers supports calculation by weight, piece, miles, or flat rate. The information is then able to be transferred to QuickBooks Online to enable easy accounting. Users are allowed to input their logistics information into the interface with non-essential features. The monthly subscription for this service is affordably priced. This bookkeeping software is perfect for you if you operate a small trucking enterprise.

It is important to note that other accounting software can be integrated with QuickBooks or other software for accounting. Service subscription is available for small companies or businesses and for an individual trucking contractor. Also, the app helps in preparation of your tax data required for tax time. This application also provides real-time trucking business receivables, cash flow, and payables. With this software, it is possible for all of your finances and account information to be synced across your different devices including iPhone, iPad, and Android. There is a QuickBooks cloud-based version, redesigned in 2013, which enables you to easily use or access it using your tablet or smartphone. This is a market leader when it comes to choosing the best accounting software according to most online reviews. While the software does not yet support the function for payroll, it still offers numerous other basic accounting functions for truckers like profit/loss statements, monitor IFTA compliance, trip reports, and invoicing. Moreover, this program for self-employed truckers offers the ability for you to be able to keep records in a simplified manner. The software is available for your use in free and paid versions. The software is perfect for owner-operators who are either just starting out or are veterans. Looking at the features offered by TruckBytes, you will understand why it is rated to be one of the best software for owner operator. Best Trucking Software for Owner Operators TruckBytes Trucking Accounting Software

REVIEWS ABOUT AXON TRUCKING SOFTWARE DRIVER

Do you want to know how much does an owner-operator truck driver make? gives you a perfect answer. If the trucking business is not profitable then you have to implement the necessary changes. Trucking software can help you determine your monthly earnings. You must pay business expenses and set aside some cash for taxes, repairs etc. The money that you are paid for the service rendered does not all belong to you. Having trucking software will help you to be able to exclude your personal and business expenses from the tracking business. Lack of record keeping and reviewing often negatively affects the salary of a driver and eventually the health of the business. Most truck owner-operators usually do not keep their business operation records and review their numbers. How software affects the truck driver salary The advantage of using owner operator trucking accounting software is the ability to be able to undertake fleet-specific tasks including IFTA tax reporting, settlements, and load tracking. These specialized features may include supporting tracking of driver and vehicle and generate a trip report. Therefore, the truck software must not only possess the standard accounting features including general ledger and accounts payable/receivable but also have other specialized features. Put in a simple manner, trucking companies require specialized accounting needs. However, some industries including the trucking industry require more specialized accounting software solutions to be able to realize associated benefits.

The standard accounting software can work for the needs of most industries.

0 kommentar(er)

0 kommentar(er)